Every year we survey our private client investors about their thoughts on alternative investments and portfolio allocation against the prevailing economic and market environment. The results of our 2022 survey are summarised in the below press release.

- High net worth investors carving out more space in portfolios for alternative assets: 4 in 10 now have weightings of 20%-plus

- Research points to a radical overhaul of the traditional 60% equities/40% bonds mix in quest for superior returns and diversification

- 1 in 3 plan to increase exposure to alternatives, compared to just 1 in 7 for quoted equities

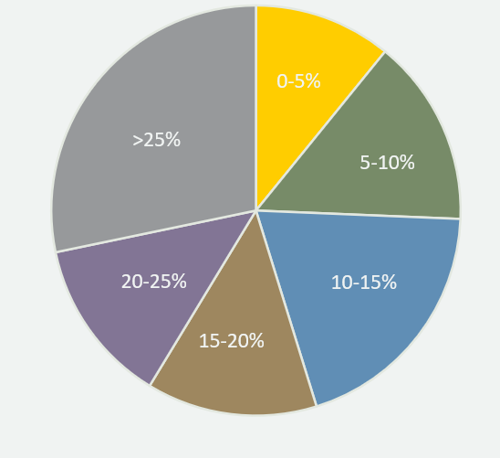

High net worth investors (HNWIs) are including much higher weightings of alternative investments in their portfolios than five years ago, with 4 in 10 investors (41%) now allocating more than 20% to the asset class, reveals research1 by Connection Capital, the specialist private client alternative investments business.

Private investors’ exposure to alternative investments has been increasing steadily as they hunt for superior returns and diversification from quoted markets. In 2018, the first year the survey was carried out, a quarter (26%) of respondents had 20% or more of their portfolios invested in alternatives, and this had risen to around a third (35%) last year.

Almost three-quarters of HNWIs (74%) are now allocating more than 10% of their portfolios to alternative investments, up from just over two-thirds (68%) last year and half (50%) in 2018, demonstrating how mainstream the asset class has become. Alternative investments includes private equity, private debt, commercial property, infrastructure and alternative fund strategies.

The findings point to a major overhaul of the traditional portfolio mix of a 60% allocation to quoted equities and 40% to bonds, as investors look at ways to safeguard their capital and make money as economic and financial market conditions deteriorate.

Q1. Roughly what per cent of your investment portfolio is allocated to alternative investments

(private equity/debt; commercial property; infrastructure; alternative fund strategies)?

Interest in alternative assets gained extra momentum during the turmoil of the Covid-19 pandemic, when many private investors increased their liquidity so that they could seize good investment opportunities when they arose.

Claire Madden, Managing Partner at Connection Capital comments, “Experienced private investors are not just dabbling in alternative investments – many are carving out a significant space for them as a vital component of their portfolios.”

“Inflation, rising interest rates, recessionary fears and geopolitical risks have re-ignited turbulence in global equity and bond markets and the conventional wisdom that a 60/40 equities/bond split is a safe diversification play – which has been doubtful for some time – no longer rings true.”

“The private capital community is questioning where they can find the best performance and generate outsize returns. The answer for growing numbers of savvy high net worth investors is to turn to the alternative markets.”

“One of the attractions of alternative assets as an investment class is that it is so wide-ranging: you can diversify into alternatives and then you can diversify within them as well.”

“Private investors are particularly on the lookout for investments where returns are capital in nature, and where there is scope to be opportunistic, for example, where market volatility has had an impact on pricing.”

One in three HNWIs (33%) plan to increase their exposure to alternative assets over the next 12 months, whereas only one in seven (14%) expect to increase their exposure to quoted equities. Fewer than a fifth (18%) say they feel optimistic about the outlook for quoted equity performance over the next 12 months.

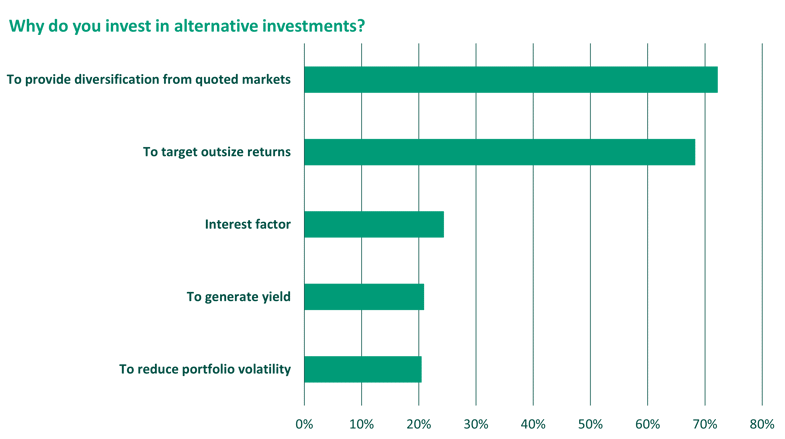

7 in 10 HNWIs choose alternative assets for superior returns and diversification

Private equity riding high, but private investors are open-minded to a variety of options

Private equity is the most sought-after alternative investment class, with single private equity transactions and growth and buyout funds seeing most interest from private investors, followed by special situations and distressed debt funds, later stage venture capital investments and PE secondaries strategies.

Private equity’s position as a long-standing top performer is a key motivator. According to McKinsey2, private equity has been the highest-performing private market asset class over the past decade with a median net internal rate of return (IRR) of 19.5%.

It also continues to outperform public markets, with median funds in every private equity vintage since 2009 returning at least 1.06 times their public market equivalent to date.

Claire Madden says, “Since many private investors have created significant wealth by running successful businesses themselves, and due to its consistently impressive performance, private equity is often a frontrunner when it comes to considering which alternative assets to invest in.”

“However, we are also seeing a lot of open-mindedness about options such as private debt, commercial property, infrastructure funds and other alternative fund strategies as the opportunity set and value proposition become clearer and investors get more comfortable with the idea of branching out.”

Download the research analysis pack.

About Connection Capital

Connection Capital LLP is a specialist syndicator of investment funds from private professional investors into direct private equity, private debt and commercial property deals, as well as alternative asset funds. As at 30 June 2022, it currently has some £400 million of funds under management across a diverse portfolio. Connection Capital provides a specialist managed service to help professional clients build up their own alternative asset portfolios. Private investors self-select which opportunities they want to take a stake in. Opportunities are identified and negotiated by Connection Capital, which also carries out all due diligence and manages the investment from completion through to exit, on its clients’ behalf. Connection Capital is authorised and regulated by the Financial Conduct Authority.

Press enquiries:

Claire Madden

Managing Partner

Connection Capital

020 3696 4010 or 07764 241476

Russell O’Connor

Headlines for Business 07760 282586

1 Survey carried out among Connection Capital clients between June 8 and 23 June 2022. 230 out of around 1,500 clients took part. Connection Capital clients’ total estimated net worth is over £11 billion.

2 McKinsey Global Private Markets Review 2022: Private markets rally to new heights, McKinsey, 24 March 2022