In the current market environment it can be difficult to decide where to invest for growth. If we look at historic data we can see that private equity funds are capable of delivering superior returns in times of market stress. In fact, the very best performance is achieved by those funds which begin investing during a downturn and the immediate aftermath.

Private equity funds deliver superior returns in times of market stress.

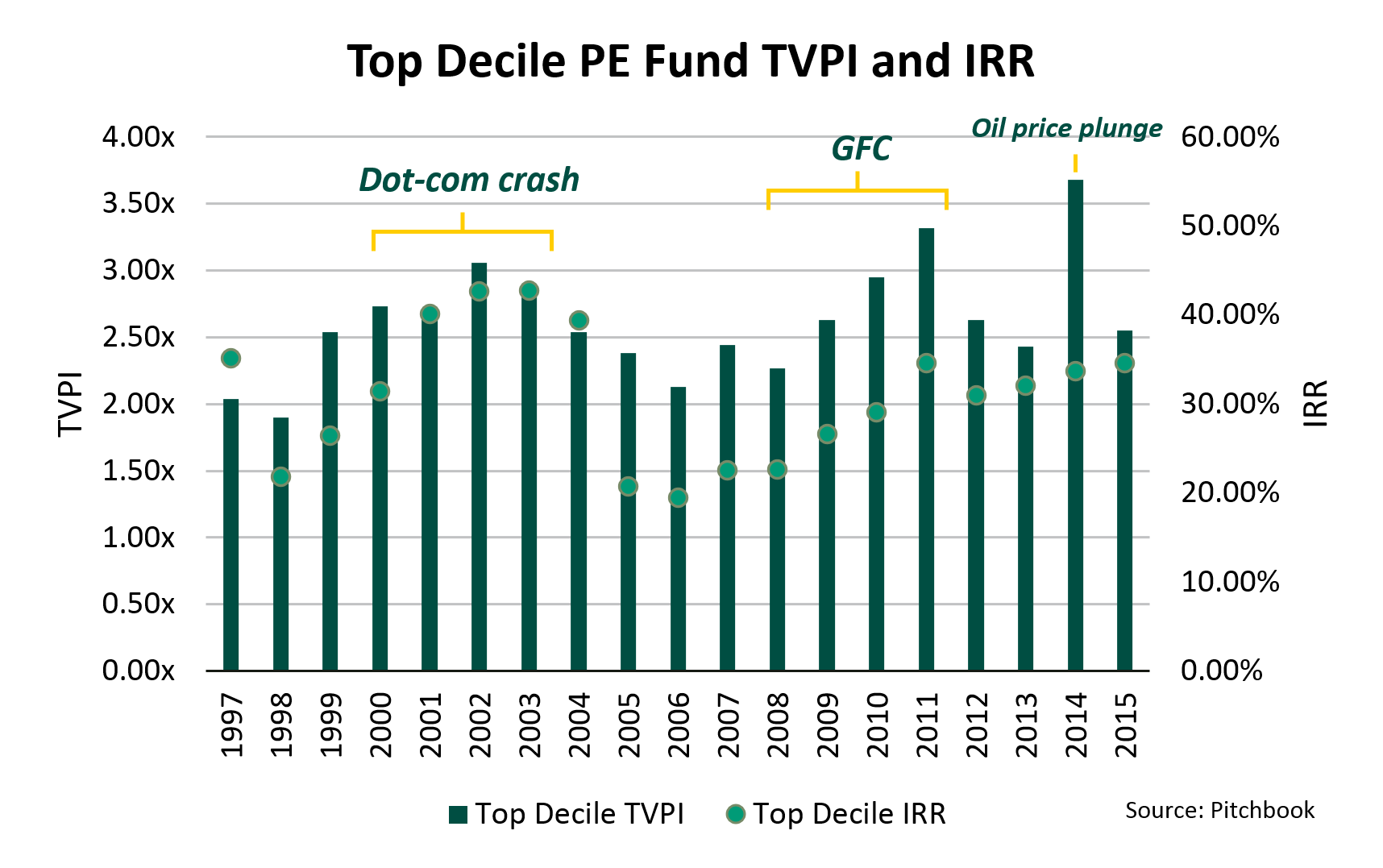

The chart below shows the total value to paid in multiple (TVPI) and the speed of which capital is returned to investors (the internal rate of return or 'IRR') for top decile funds which commenced investing between 1997-2015.

The highest returns are for 'crisis-era' vintages, i.e. those invested during economic downturns, such as the Dotcom bubble of the early 2000s, the GFC in 2008, or the oil price plunge in 2018.

Conversely, over the same periods, public markets suffered initial declines in response to market shocks, which was then followed by benign performance.

Private equity performance beats public markets across the entire market cycle

As we've seen above, private equity has demonstrated its ability to outperform public markets in times of stress. But what about across the market cycle?

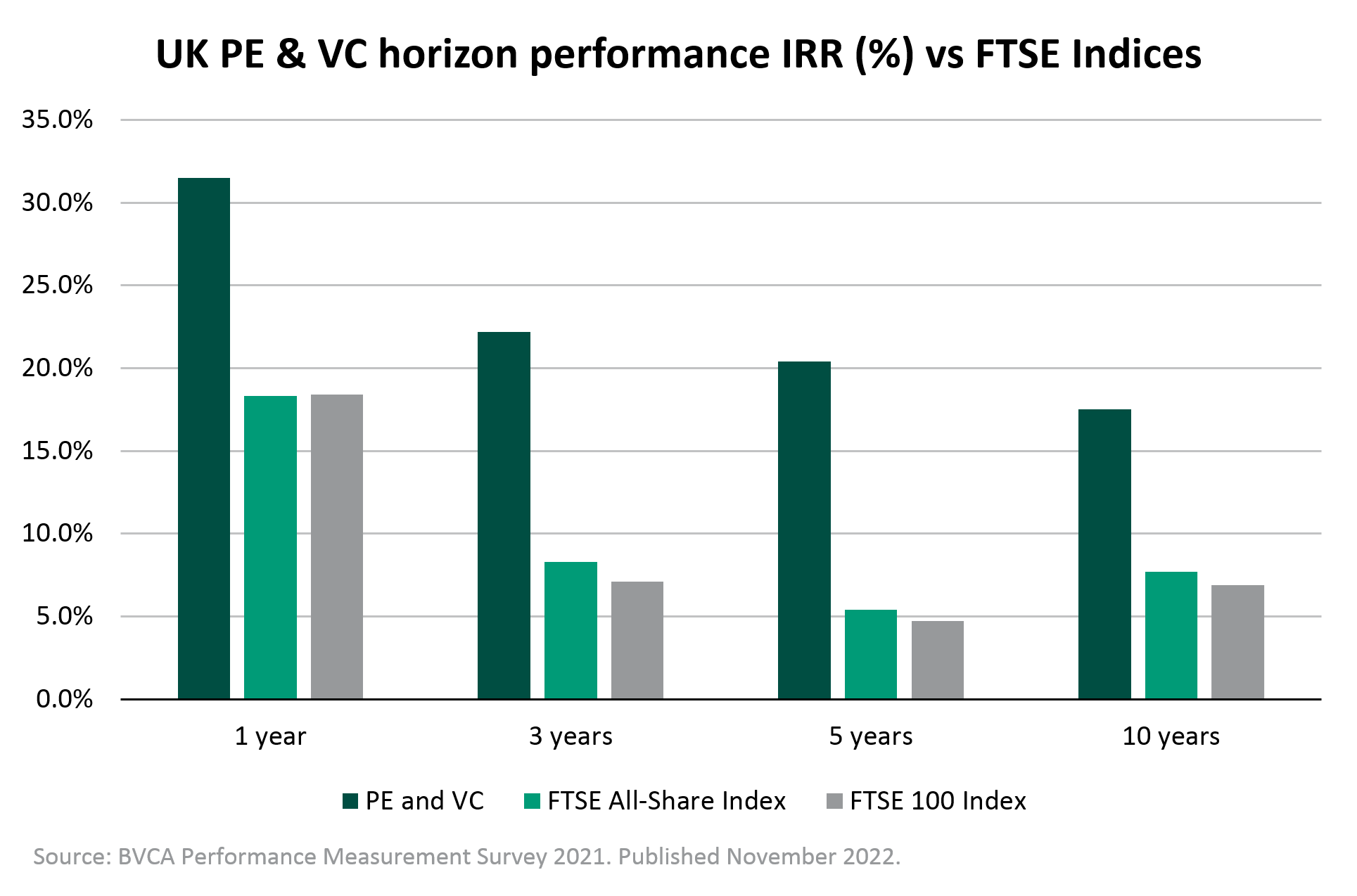

Data from the BVCA's most recent performance measurement survey shows that private equity has outperformed public markets over 1, 3, 5 and 10 years.

If we look at the results of our own analysis, by comparing the net asset values of the S&P500 and a private equity index (both rebased to 100 as at Q4 2015), we again see the outperformance of private equity over the public market. What is also evident is the reduced volatility of private equity, with performance declining less than the public market equivalent in times of market 'shock'.

How does private equity outperform public markets?

There are several key factors underpinning private equity's ability to outperform public markets.

Attractive pricing

Market dislocation creates opportunities. When fundamentally strong companies suffer they become temporarily undervalued and the pricing becomes more attractive. Private investors actively seek these opportunities to 'buy the dip' and benefit as the valuation recovers. It's easier to sell high when you've bought low and as patient investors, private equity can take a long term view and sell when the best conditions present themselves.

Active management and value creation

Depending on the deal type private equity investors are able to exercise varying levels of control over portfolio companies. Professional investors are able to assist companies by sharing experience of other companies they have invested in helping them develop new capabilities and grow in new ways. Dedicated 'value creation' teams will employ a playbook to support companies to grow. This could be through acquisition, entering new geographies, launching new products, people change or digital transformation.

Access to further funding

Private equity managers are able to support portfolio companies with access to additional funding when required. This may be to see the company through a period of stress or to take advantage of the opportunity to grow the company through acquisition. These opportunities tend to rise during recessions as weaker companies fall by the wayside.

Specialists can prosper

Private equity investors which specialise in a particular geographic region or market can outperform even further (see below).

The value of a specialist

If we refer back to our our analysis of top performing private equity funds, there is clear evidence on both a MOIC (multiple of invested capital) and IRR (internal rate of return) basis that specialists can significantly outperform generalists.

We can see that the strongest performers are those that have a direct area of specialism, specifically sector, geographic or deal-type.

This shows that specialists are not only capable of delivering higher absolute returns than generalist private equity investors but also that money is returned to investors much quicker too.

Why do specialist private equity managers often beat generalists?

Because specialist managers generally have better access to deals, due to their more focused deal sourcing networks. This often facilitates transactions which are 'off-market' with more attractive pricing. They then put to work specialist, relevant knowledge to apply value creation levers.

This impact of this 'specialist premium' is evident across all market conditions.

Insight summary

- Historic data shows that private equity has outperformed public markets. Previous recession data shows that private equity funds deployed in downturns can achieve 'best vintage' returns.

- The inherent characteristics of private equity (patient capital, active management, focus on value creation) underpin its ability to outperform public markets and display resilience under market stress.

- Private equity managers which specialise in a specific area can outperform generalist PE investors in both in terms of return multiple and time taken to return capital to investors.

Methodologies

Geographic Specialists vs Generalists Methodology: Geographic Generalist is defined as those top-quartile mega managers that have a global presence with a Pan-European strategy. These ‘generalists’ include the likes of KKR, Cinven and Apax that have a ‘Europe’ strategy. Geographic Specialist is defined as those top-quartile managers that have a direct presence only within three specific areas in Europe: UK, DACH or Nordics. To ensure an ‘apples to apples’ comparison, only Private Equity buy-out strategies were selected, and each year was compared against strategies that were top quartile performing strategies of their vintages. I.e. Top-Quartile Pan-European Strategy from mega manager vs. Top-Quartile Nordic-Focused Strategy from Nordic Manager.