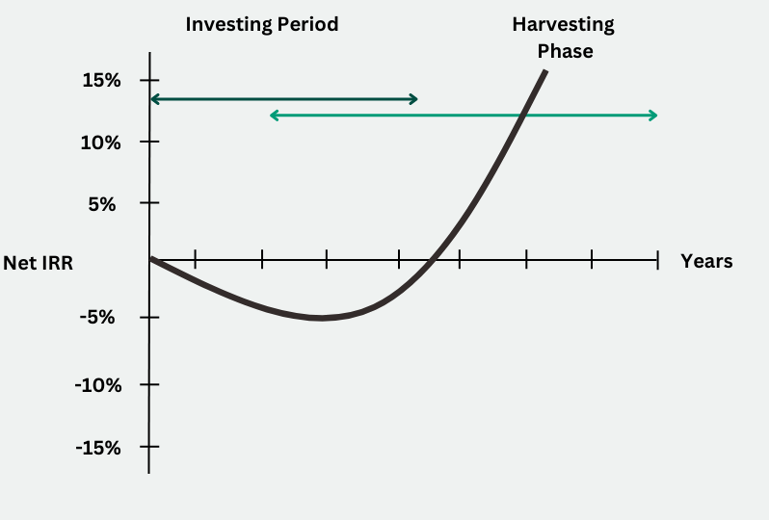

In private equity, the J-curve is used to describe the shape of a fund's anticipated performance, as plotted on a graph, from inception through to exit.

This shape represents low returns at the start, followed by a gradual increase and recovery to a point that is much higher than at the start.

What is the J-Curve

The J-curve reflects a situation where an investment has negative returns at first, for a period of time before then entering a period of recovery.

At the beginning of a fund's life, during its investment phase, the fund draws capital from investors and fees are taken. Over time, the underlying investments grow in value and, as capital is returned through distributions and realisations (exits), the curve is expected to reverse trajectory, return investors' capital in full and continue on an upward ascent as profits are delivered in the fund's 'harvesting' phase, until it reaches full maturity.

When plotted on a graph (time versus returns), the resultant shape looks like a J. The shallowness or steepness of the J will depend on the amounts drawn and returned and the speed with which this occurs.

J-curve in private equity

In private equity, the J-curve is common. Private equity funds commonly enter a period of negative return in their initial years. This can be dependent on different factors but it typically is down to management costs, investment costs and operational fees as well as a portfolio that hasn’t yet matured. Once matured, however, the returns can rise well beyond their starting point — forming the J-curve.

In the initial stages of a private equity fund, there is unlikely to be much in the way of distributions and realisations to investors.

This initial stage is referred to as the ‘investment period’. During this first stage, the investment manager will work to source companies to acquire for the fund. It is only after the companies are acquired that the investment manager will work to form a business plan, which works to increase revenue and profit margins.

The business plan can take a significant amount of time to show the effects. Coupled with additional costs associated with setting up the fund, it results in the negative returns seen at the first points of the J-curve.

However, when a private equity fund is managed well, it will see increased gains and returns after mergers and acquisitions and buyouts begin. Additional cash flow is then used to pay down debts and is returned to investors. This forms the upward trajectory of the J-curve. The steeper the upward curve, the faster the private equity fund has been in generating returns.

What Affects the J-Curve?

The J-curve isn’t always the same, and it will appear differently depending on the circumstances. Sometimes the ‘investment periods’, wherein returns are negative, can be longer, or more intense which can result in a steeper or more drawn-out curve. Alternatively, the investment period might be shorter, with positive returns being achieved quicker, resulting in a sharper curve. Different fund strategies and investing environments will also affect the J-curve.

There are many factors that can affect the J-curve, including:

Time

As the J-curve takes into account the time taken to see positive returns, it can have a big impact on the curve. A longer negative return time will see a more drawn-out start to the ‘J’ whereas a shorter period of negative return will see a shorter start.

Additionally, the graphs used to measure private equity funds typically note the initial rate of return (IRR) to measure success. IRR is a metric that uses a discounted cash flow methodology, taking into account the time value of money. This can have a big impact on the J-curve too. The longer it takes for the investment manager to drive profits, the deeper the J will appear.

Market conditions

Multiple privately owned companies are likely to form part of a private equity fund, so it can be susceptible to various market conditions. The privately owned companies are evaluated quarterly against different metrics:

- Public equity comparable valuation

- Discounted cash flow valuation

- Comparable sales valuation

This means the companies are measured based on their value compared to similar companies in the same sector that are publicly traded, their value compared to cash flow metrics and their value compared to a similar company that was sold in the same quarter.

Therefore, if a certain sector sees a large shift, whether negative or positive, it can have a big effect on the J-curve.

Dramatic changes to a portfolio company’s expected revenues or profits, such as if a large client is won or lost or in the event of a cash flow disruption, can skew the J-curve.

Manager skills

An investment manager manages private equity funds. Its role is to source companies for the private equity fund and to manage the fund over time, aiming to meet the fund’s investment objective and performance targets.

If the investment manager can source companies that perform and then exit in a relatively short timeframe, the curve may be significantly shorter. Similarly, if the investment manager has trouble sourcing companies, or suffers poor performance in the early stages, it can lead to a longer curve as the fund takes much longer to reach full maturity.

How to Create a Self-Funding Portfolio

By investing in multiple private equity funds, each with a different J-curve, drawdown and distribution schedule, investors can create a portfolio that may see consistent returns over time. This strategy could help to offset the J-curve by potentially creating steady returns.

In order to choose the best private equity funds for a portfolio, it is important to understand the investment strategy and exposures behind each to ensure there is enough diversity to increase the likelihood of stable returns. Connection Capital aims to offer investors access to a wide range of funds to enable private investors to build a thorough portfolio.

Within private equity, the J-curve can be affected by a number of factors, including market volatility as well as time and other conditions. However, it can be expected within private equity that there will be a period of negative return before capital is returned through distributions and realisations. This is due to expected costs from the initial investments and debts to be repaid and the time taken to generate returns from underlying investments.

By investing in a diverse range of private equity funds over time — each with different exposures and different sources of risk and return — investors can target the creation of a self-funding portfolio. One whereby distributions and realisations from more mature private equity funds are recycled into new private equity funds, without having to commit additional ‘new’ capital. To find out more about how to create a self-funding portfolio, contact Connection Capital today.

Please note:

Private equity investments are high risk and speculative which means there is no guarantee of returns and investors should not invest unless they are prepared to lose all of their money. Past performance is not a reliable indicator of future performance. This type of investment is illiquid so can’t be easily accessed until the exit point. The investor is unlikely to be protected if something goes wrong.