In this whitepaper we cover:

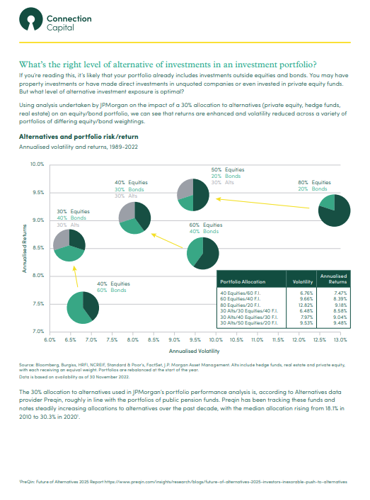

1. How an allocation to private equity and other alternative investments can be used to target higher potential returns and lower volatility than a traditional 60:40 equity/bond portfolio.

2. Why alternative investments can increase the diversification of an investment portfolio.

3. How a portfolio could become ‘self-funding’ through exit proceeds and investment realisations.

Against a backdrop of low economic growth, high inflation and geopolitical tensions, now more than ever investors need to be thinking strategically about asset allocation and how they construct their investment portfolio to achieve their investment goals.

At Connection Capital we believe alternative investments have a prominent part to play. Asset classes such as private equity and private debt are capable of improving the diversification of an investment portfolio and can target higher potential returns, with lower volatility, than traditional public market equivalents. The problem for individual investors has historically been – how to access these asset classes?

Hopefully, as you’re reading this, you’ve gathered that we can help. We set up our business in 2010 to help investors access alternative investment strategies from low minimum investment levels (all of our investment opportunities are available to investors in multiples of £25,000).

Since then we’ve established an incredibly strong network of industry relationships which has enabled us to offer our clients a wide range of alternative investment opportunities, from direct investments in established, profitable private companies to private equity funds operated by some of the world’s best performing specialist private equity managers.

In this whitepaper, “Using Alternative Investments to construct a diversified, robust and self-funding investment portfolio”, we explain more about how an allocation to alternative investments can improve returns and reduce volatility when compared to a traditional 60:40 equity/bond portfolio.

We also look at why alternative investments improve the diversification of an investment portfolio and how an investment portfolio with an allocation to alternative investments such as private equity could become ‘self-funding’ through exit proceeds and investment realisations over time.

Click the image below to download the full whitepaper.