In March 2016 we completed a £5.5 million investment to back the management buy-out of ESG, a leading independent specialist glass processor. Shawbrook Bank also supported the transaction with a £5.6 million debt package.

The company

Established in 2003, ESG is a leading independent specialist glass processor, involved in the design and manufacturing of a wide range of technical glass products for architects, specifiers, contractors and construction professionals.

Investment rationale

Investment to support an MBO of a growing, well-established, specialist, high-value-added glass process manufacturer with additional growth capital provided to fund a site consolidation.

Support an experienced management team with a long and successful track record in the sector with attractive underlying sector dynamics.

Undertake a site consolidation to create a best-in-class manufacturing operation to increase operational efficiencies, support future growth and enhance market leading position as the supplier of choice.

Progress since the investment

Following the transaction the company successfully consolidated three manufacturing sites into a new best-in-class single manufacturing site. New, automated manufacturing machinery increased capacity, quality, efficiencies and reduced lead times.

This investment enabled the company to enter new product markets and targeted a wide range of new customers to fuel growth. We also bolstered the management team with a CFO and new Operations Director.

In February 2026 ESG made a complementary acquisition of Euroview Architectural Glass a £14m revenue manufacturer of high-performance insulated glass units to create a £30m revenue group. This demonstrates our approach of backing management teams with flexible capital and strategic guidance to pursue disciplined growth opportunities.

"I had a good feeling about the Connection Capital team. I felt they were people we could work with and who took a real interest in the business."

Scott Sinden, CEO of ESG

ESG Deal Team

View full SME Investment TeamYou might also be interested in

Private Equity

23.5 Degrees

Growth capital support for the world's first Starbuck's franchisee.

Discover more

Private Equity

Clamason Industries

£5.4m investment in the MBO of specialist manufacturer with international client base.

Discover more

Private Equity

HEL Ltd

£5.8m investment in scientific instrument maker and software developer HEL.

Discover more

Private Equity

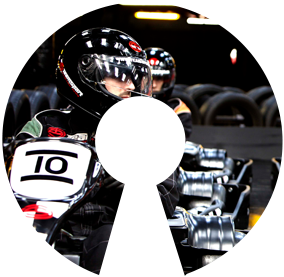

TeamSport Karting

Rapid growth for the UK's largest indoor go-kart operator returns 4.1x in four years.

Discover more