Investing in private debt offers the opportunity to target yield, through interest payments, and potentially an uplift in the capital value of the company borrowing the money (depending on the structure of the deal).

As debt is a lower-risk asset class than equity, the returns are expected to be more modest than the returns from private equity investment.

Private debt explained

What is private debt?

Private debt, also known as private credit, refers to loans to companies which are not provided by banks or public markets, and instead are provided by private markets.

As private credit is not traded or issued on the open, public markets, investments are not always readily realisable. It is therefore an illiquid asset class and investors must be willing to tolerate this illiquidity.

The distinction between private debt and private equity is that capital is provided via a loan rather than buying a share of the company’s equity. Returns tend therefore to come via interest payments and the return of the principal. In some situations there may be an opportunity for the investor to participate in the growth of the underlying company through negotiation of a small equity stake or warrant as part of the terms of the loan.

There is a vast spectrum of risk/return profiles within the private debt asset class. In general terms, as debt has a higher priority in terms of repayment than equity, it is considered, in comparison, a lower risk investment asset class - with a commensurate reduction in target returns too. Of course, the exact details will depend on the specific opportunity.

Public debt vs private debt

Public debt can be invested in and traded on public markets, for example bonds (loans to corporates and governments), and tends to be a relatively low risk/low returning fixed income investment. As the returns are ‘fixed’ they can be less attractive when interest rates rise as their returns lag the market.

The returns from private debt compare favourably to those of public debt. Understandably investors want to be compensated for the illiquidity that features where there is no tradable market for their investment. This means private debt investments tend to pay higher yields. This is known as the ‘illiquidity’ premium. Some private debt investments also vary their yield based on an underlying interest rate. These ‘floating rate’ debt investments aim to provide investors with flexibility in a rising interest rate environment.

Private debt is also more likely to be secured than its public market equivalent e.g. bonds or gilts (asset manager abrdn states that around 95% of public market issuance is unsecured (source abrdn.com)). These factors contribute to private debt’s superior risk-adjusted returns over public debt.

Why invest in private debt?

The private debt asset class offers investors multiple attractive benefits such as: portfolio diversification, reduced volatility, the potential for superior risk-adjusted returns and a way of targeting returns that are less correlated with public markets. We explore each in turn below.

Potential for superior risk-adjusted returns

Offering more flexibility to a borrower than a traditional lender would be willing to provide does not necessarily mean an increase in risk. Indeed, because companies are prepared to pay a higher interest rate, the targeted return is therefore higher, ultimately creating a more attractive risk-adjusted return.

Some direct private debt deals may also include a small equity share in the company: not as much, clearly, as in a full private equity deal, but some degree of ‘equity kicker’ to further enhance returns potential and share in any upside as the company grows.

Target reliable income streams

Investing in debt can provide investors with a predictable stream of income through regular, scheduled, contracted repayments.

Reduced volatility

As investment returns from private debt often take the form of regular repayments, the asset class can be used to reduce the volatility of a portfolio which includes equities, where the timings of returns, through exits and realisations, are less predictable.

Portfolio diversification

Private debt provides opportunities for investors to diversify sources of risk and return for their investment portfolio through a differentiated asset class. Contractual repayments on a loan are unaffected by the market for mergers and acquisitions or other exit routes such as a stock market listing which holders of equity in a private company are targeting. Private debt is commonly used to provide diversification from equities.

Diversified sources of income

Investing in a diverse range of private debt opportunities spreads risk. Diversity of income source can be achieved through investing through multiple companies but also different entry routes to the asset class such as direct investments, co-investments and investments in private debt funds, which may target companies of different sizes, in different sectors and using differentiated private debt strategies.

Diversification from public markets

Investments in private companies, including private debt investments, have not historically been correlated with public markets or traditional fixed-income assets.

Inflation hedge

In an inflationary environment and with rising interest rates, many traditional fixed income debt investments such as gilts or bonds have their returns eroded. Some private debt strategies invest in floating rate loans which means returns are not fixed and can vary against a reference point. These strategies can be used to hedge against increases in inflation and central bank interest rate rises.

What are the investment returns from private debt?

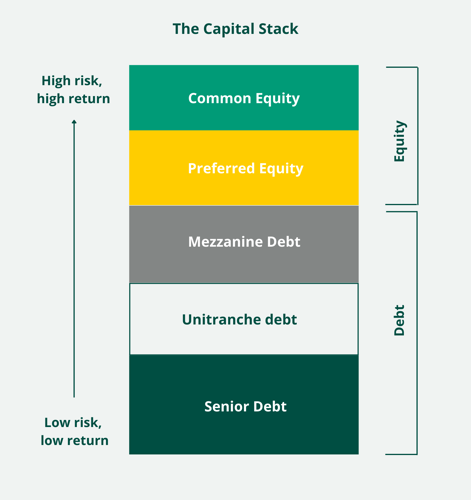

Private debt can offer investors attractive risk-adjusted returns, which are less correlated with the performance of public markets and may provide regular income payments. The range of those potential returns correlates with the type of debt provided and its position in the company’s capital structure which dictates the order capital is returned to investors/lenders in the event of sale or liquidation.

Senior debt, often provided by a bank, is the first in line, making it the lowest risk. Target gross annual returns from a senior debt investment are around 4-7%. This is followed by unitranche debt (8-14%) and then mezzanine debt (15-20%). Equity is higher risk but has higher return prospects as it is last in the capital stack.

How to invest in private debt

Connection Capital offers access to private debt investment opportunities in a variety of ways:

Direct

Sourced and diligenced by our Direct Investment team with a focus on direct lending investments in profitable UK SMEs. Read more.

Co-investment

Single asset transactions we source through third party managers. Read more.

Private debt funds

We source, diligence and enable access to a diverse range of third party managed institutional-grade private debt fund strategies ranging from direct lending to structured credit funds and most things in between. These private debt strategies are highlighted below. You can read more about our approach to Fund selection here.

Private debt investment strategies and opportunities

There are a range of different debt strategies that investors can choose to access the private debt asset class through. A summary of the main types follows:

Direct lending

Lending directly to companies. Loans could be in senior position through to mezzanine.

Distressed debt

Purchasing debt at a discount from existing lenders where the loanee company is experiencing financial distress. Returns are generated from selling the debt once the company has recovered.

Special situations or 'opportunistic credit'

Opportunistic investment strategy which seeks to identify mispricing or ‘situations’ which have temporarily suppressed the valuation of a company or its debt and where the value will recover once the situation resolves.

Venture debt

Lending to start-ups or venture stage companies. A growing market in the current environment as increasing numbers of later stage venture-backed companies are turning to venture debt to extend their cash runways. Interest rates on loans to these companies can be between 10% and 20% and often include warrants for shares.

Non-performing credit

Specialist investing strategy which involves purchasing a book of loans which are in default, at a discount, and implementing measures to recover value above the purchase price.

View current opportunities to invest - register here

Insights on the private debt industry

Private debt market

The private debt asset class emerged in the ashes of the 2008 global financial crisis. As banks and other traditional lenders reduced their risk appetite and retrenched their lending activities, particularly to SMEs, a gap in the market was created. This allowed alternative lenders to step in to service the financing needs of these businesses.

The dislocation led to a great surge of innovation, to the extent that today the private credit marketplace comprises many providers and covers a wide variety of lending types. These range from peer-to-peer lending to private credit funds specialising in a whole host of strategies, and even hedge funds are getting in on the action. The breadth of strategies under this umbrella offers those opting to invest in private debt access to a wide range of returns and plenty of diversification.

Competition between those looking to lend to businesses has meant the creation of a wide range of innovative debt offerings including lending which is more suited to the needs of the borrower than a traditional lender would offer.

Private debt and SMEs

As the market has evolved, the impetus for SMEs to seek private credit has changed too. No longer is it principally driven by a lack of access to bank lending – instead, many SMEs are attracted by the greater flexibility on offer elsewhere.

That flexibility could take the form of loans that are structured to allow for interest to roll up into one final bullet repayment at the end of the term, instead of the usual amortising loans that banks offer. This provides more headroom for growth as the company is not encumbered with regular capital and/or interest payments.

Loans that allow for payment holidays in certain circumstances without penalty, or impose lighter covenants on the business, putting it under less pressure to continually demonstrate it is conforming to strict requirements can also be attractive to borrowers. During the global pandemic, when changeable trading conditions put budgets under constant review and necessitated a regular re-adjustment of forecasts, that proved more valuable than ever.

For many SMEs, the higher interest rates payable on private credit agreements are well worth it to achieve this flexibility and to ensure that loans are tailored specifically to suit their unique needs. Instead of endlessly focusing on paying down debt and worrying about whether they still meet covenant tests, they have space to concentrate on running and growing their business, and ultimately creating value.

Private debt market size

Since it emerged, private credit has gained rapid momentum as a credible, appealing alternative asset class for borrowers and investors alike. In the space of just over a decade, it has gone from niche to mainstream, with $1.2trillion of assets now under management globally – a figure which is forecast to double by 2026 (source: Preqin).

In the UK, data from the Alternative Credit Council (ACC) indicates that around 2,000 British businesses are currently receiving some £100billion in total of private credit from asset management firms in this space, demonstrating what an important source of funding it has become.

Why Connection Capital for private debt investments?

We offer clients a range of opportunities across the private debt asset class and the risk/return spectrum for them to diversify their portfolio. Our focus is on differentiated investment opportunities which are robust and otherwise hard to access.

For our direct private debt investments we look for businesses that are already profitable and where there is the potential to take a minority equity stake to target upside. Co-investments allow us to offer clients exposure to the debt of much larger companies and property assets.

Our Funds product line enables access to an array of specialist managers. We steer away from the global investment giants which tend to invest in competitive markets and prefer specialist, opportunistic managers and strategies in markets where there is more attractive pricing which is supportive of strong risk-adjusted returns.

Investment requirements

Access to this asset class is not easily available to private investors, but through Connection Capital you can choose to invest in whichever of our private debt opportunities you wish, in multiples of £25,000.

Register to view current private debt investment opportunities

Private debt highlights

Selected historic private debt investments we have offered our clients are below.

Private Debt

Spotless Water

Senior debt growth capital with equity into a high growth, profitable, B2B provider of ultra-pure water via an established UK site network.

Discover more

Private Debt

BW Legal Services

A leading legal services business specialising in the outsourced collection of high value, low volume overdue consumer receivables.

Discover more

Funds

Permira Sigma VI

Private debt strategy targeting high income yield through CLO investing.

Discover more

Private Debt

Bredbury Hall and Country Club

Acquisition of historic freehold hotel in Stockport.

Discover more

Funds

SCIO ESCF III

Niche private credit fund targeting underserved sub €25m loan market.

Discover more

Funds

Permira Sigma V

Specialist debt fund investing in European CLO market, operated by global, blue-chip manager.

Discover more

Funds

BCI Credit Opportunities Fund

Niche credit strategy serving the growing alternative lender market

Discover more

Private Debt

Torquay Leisure Hotel

Debt support for MBO of popular Torquay multi-site hotel.

Discover more

Funds

Lendinvest Income Fund

Short-term fixed income fund which provided real estate bridge finance and development loans.

Discover more