Over the past few years private equity secondaries have undergone a transformation, from being a niche investment strategy to a fast-growing alternative asset class providing much needed liquidity options to previously ‘locked-up’ private capital. Lorna Robertson explains more.

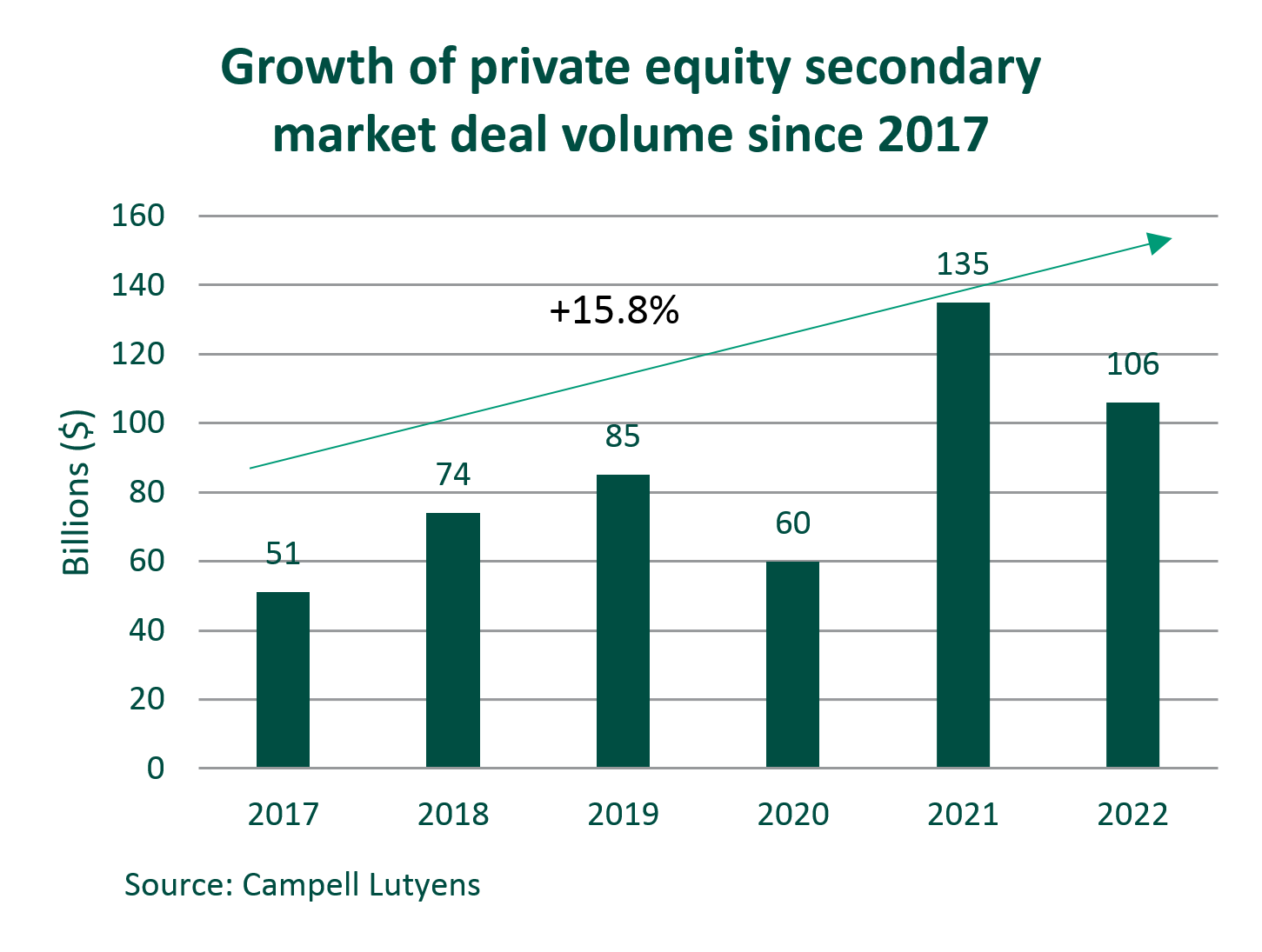

Over the past few years private equity secondaries have undergone a transformation, from being a niche investment strategy to a fast-growing alternative asset class providing much needed liquidity options to previously ‘locked-up’ private capital. Institutional investors have been attracted by the opportunity to invest in more mature, de-risked, private equity assets as fund managers look to hold onto ‘trophy assets’ for longer in continuation vehicles and current fund investors seek liquidity solutions to their holdings. As a result, secondary market volumes hit $106 billion last year despite a tough deal-making environment.¹

In this article I’ll explain the strategy of private equity secondaries, how the market has evolved, the benefits of the asset class for investors and why private investors may wish to consider an allocation to the sector in 2023.

Private Equity Secondaries Explained

Private equity secondaries are where investors buy and sell existing ownership interests in privately held companies or funds. These interests can include Limited Partner (‘LPs’) positions in private equity funds, direct investments in private companies, and other private market assets.

In a private equity secondary transaction, the buyer acquires an existing LP ownership interest from the seller. This can occur for a number of reasons, such as the seller needing liquidity, a desire to exit a particular investment, or to rebalance their investment portfolio.

Buyers are attracted to secondary investments as they offer:

- visibility (they know which assets they are investing in rather than a traditional ‘blind pool’ PE fund approach);

- a way of investing in private equity assets at a later and partially ’de-risked’ stage in their investment cycle; and

- access to a wide range of private market assets that may not be available through traditional investment channels. Additionally, these transactions can offer investors the potential for attractive returns, as the assets are typically acquired at a discount to their fair market value.

Evolution of the Private Equity Secondaries Market: LP-led, GP-led and more.

In its infancy, the secondary market was primarily driven by LPs seeking early liquidity from their private equity investments, known as ‘LP-led secondary transactions’. The LP, for example a pension fund or sovereign wealth fund which needed to reduce its weighting to private equity to align with its investment mandate, might sell its stake in a PE fund, including their entire portfolio of assets and liabilities (future capital calls), to a secondary buyer.

In recent years, we have seen the rise of the General Partner ‘GP’ led deal, where the GP works with a secondary buyer to establish a new fund, often referred to as a continuation fund or a continuation vehicle, which acquires either a single asset or a portfolio of assets from the existing fund. The existing investors in the original fund can choose to sell their interests in the fund to the continuation vehicle or roll over their investments into the new fund.

GP led deals can be beneficial to both the GP and the limited partners in the original fund. For the GP, the transaction can allow them to extend the life of the fund, continue to retain assets where they believe there is additional upside, and potentially generate additional management fees and carry. For the LPs, the transaction can provide them with greater control over the timing of their exit from the fund, as well as the potential for enhanced returns and reduced fees.

GP-led secondaries have become increasingly popular and made up 40% of the Secondaries market in 2022 (vs 49% for LP-led)².

In 2023, from an investor’s perspective, there is now a wider range of fund strategies available in the secondaries space, from low J-curve, consistent cash flow LP-led deals, to higher risk, complex secondaries and concentrated single asset GP-led funds. From a GP perspective, the range of liquidity solutions on offer is also increasing, with a continuation vehicle now increasingly seen as a plausible and credible solution to consider as an alternative exit strategy from portfolio companies, especially in an environment of suppressed IPO activity or where valuations are unable to be optimised.

What are the benefits of investing in Private Equity Secondaries?

Less blind pool risk than a primary fund

In secondary investments, investors have visibility over the asset(s) being acquired. Therefore, unlike investments in a primary fund, where capital is raised before or early on in the investment phase, there is less ‘blind pool’ risk. In addition, investors may be comforted by the GP’s desire to continue backing an asset it knows well and its track record as an investor in the asset.

Risk-adjusted returns

An investment in PE secondaries funds, can provide superior risk-adjusted returns, according to analysis from CAIS group, using Preqin data, fewer secondaries funds have lost investor capital compared to primary buyout and venture funds, however the trade-off for this downside mitigation is that, in this historic analysis, fewer secondaries funds generated net returns higher than 2.0x when compared to buyouts.

Mature assets with potential for faster distributions than a primary fund

As secondary investments are further along the hold period than primary investments, there is the potential for investors to receive distributions within the early years of investing in a secondary fund.

J-curve mitigation

Private equity secondary funds have the potential to avoid or somewhat flatten the J-curve (The J-curve effect, which is common in private equity, refers to the initial period of negative returns before investments begin to generate positive returns,where fund returns are negatively impacted in early years by fees). As explained above, LP-led secondaries are typically acquired at a discount, this can lead to high early distributions and enhanced Internal Rates of Return ‘IRRs’ which normalise over time. For GP-led transactions, private equity value creation is already ongoing which means positive impact can be seen on valuations sooner than in primary investments where more time is required.

Private Equity Secondaries - Our experience

Connection Capital clients have been investing in a variety of secondary funds for many years. These range from preferred equity strategies with 17Capital, to complex secondaries with Headway Capital and the pure play GP-led strategy operated by ICG Strategic Equity.

As the market has developed and matured, we are now seeing a much wider selection of deal types in secondaries funds from pure GP-led to a mix of LP led, direct secondaries and independent fundless sponsor led deals (which have increased due to the challenging fundraising environment).

Our secondaries fund selection process

We view secondaries as partially de-risked PE with buy-out returns. We apply the same level of diligence to every fund opportunity we offer to our clients and we will only select managers with a strong and demonstrable track record, with a preference for deal type specialists rather than generalists, as this tends to lend itself to outperformance.

In the case of GP led deals, especially those with highly concentrated portfolios, a leading market position and an investment team with a strong PE background is effectively the manager responsible for driving the process and achieving the best outcome for fund investors in the end.

Private equity secondaries: conclusion

The private equity secondaries market remains remarkably resilient and continues to grow unabated year on year, with new and innovative solutions for managers and investors alike, despite the multitude of market headwinds challenging both the public and private markets.

An allocation to the sector can provide investors with exposure to a diversified portfolio of private market assets with the potential for attractive returns as the assets are typically acquired at a discount to their fair market value. Additionally, secondaries funds may have shorter holding periods and quicker liquidity events compared to traditional private equity funds. This is in addition to the lower risk compared to primary funds as the underlying investments in a secondaries fund have already been made and are typically mature, reducing the risk of the underlying investments not performing as expected. Finally, investing in a secondaries fund can help to reduce the J-curve effect, as the underlying investments have already passed the period of negative returns. With the potential for faster cash distributions, as they normally hold assets that are closer to the end of their investment cycle.

An investment in this complex asset class was previously restricted to institutional investors, but Connection Capital has sought to partner with top-tier managers to bring a variety of secondary strategies to our investors. An allocation to the sector is attractive to investors looking to increase or complement an existing private equity allocation to be held as part of a diversified private investments portfolio.

¹ Campbell Lutyens: 2023 Secondary Market Overview published 28 February 2023.

² Secondaries Investor